Curious about how health insurance works and why it’s so important? Think of health insurance as a sturdy umbrella, keeping you dry when unexpected (and expected) health care costs pour in.

While no one plans to get sick or injured, everyone requires medical care or prescriptions eventually. Health insurance helps you pay less for these, whether you have a minor illness or serious injury.

Getting the most from your health insurance plan

To get the most from your health insurance plan, you need to know how it works. Here’s a helpful guide:

- Pay your premium: A premium is the money you pay — usually monthly — to ensure you have health insurance coverage when you need it. Think of it like a membership fee. If you get your health insurance through your job, your premium is usually taken out of your paycheck automatically. If you’re eligible for a subsidy, the government may cover some, or all, of your premium.

- Choose a primary care doctor: Depending on your health plan, you may be matched with a primary care doctor near you. Or you can choose a doctor from your plan’s network at any time. Most insurance companies have an online provider directory you can search 24/7.

- Stay on track with preventive care: Most plans cover things like an annual checkup, cancer screenings, vaccinations, and bloodwork for cholesterol and diabetes. And there are often extra benefits, like care programs for chronic conditions or discount programs to save on health essentials.

- Get care when you’re sick: If you get sick, your doctor is there to help you feel better. If they’re not available, an urgent care center can be a convenient and cost-effective alternative to the ER for non-life-threatening conditions.

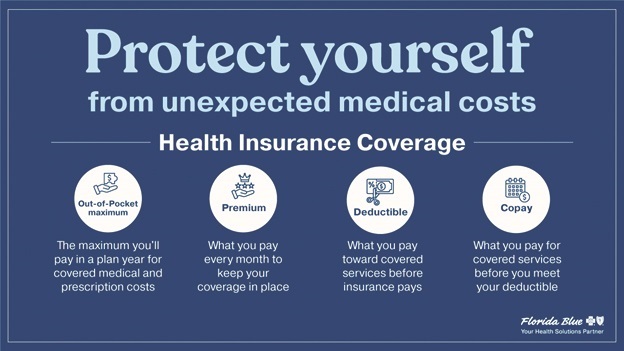

Understanding your cost share

It’s essential to know what you’ll need to pay out of pocket for medical care and prescriptions. Here are some key terms to understand:

Deductible: The amount you must pay toward your costs of covered services before insurance starts to pay.

Copay: A flat fee you pay for covered medical care and prescription drugs, usually before you meet your deductible.

Out-of-Pocket Maximum: The maximum amount you’ll pay in a plan year for covered medical and prescription drug costs. Once you reach this amount, your health plan pays 100% of all covered services for the rest of the plan year.

Coinsurance: The percentage of covered medical or prescription drug costs you pay, usually after you meet your deductible.

Learn more about how health insurance works at GetCoveredFlorida.com.

If you need help, you’re not alone. Florida Blue has been serving the state for almost 80 years and is the only insurer offering health plans in every county of Florida. Connect with a local licensed Florida Blue agent, visit your neighborhood Florida Blue Center, or call 1-800-876-2227 for help finding the right plan and making sure you get the financial help you qualify for.