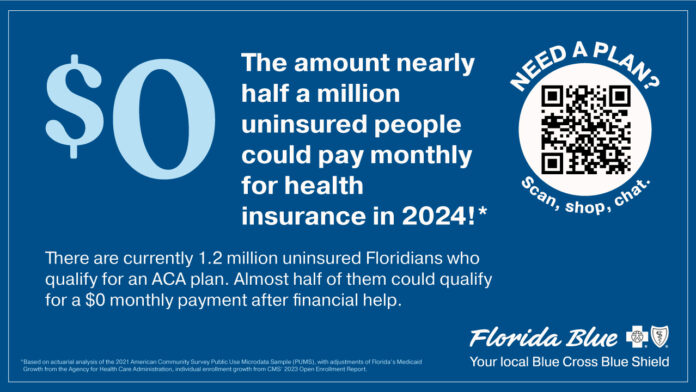

Sometimes health insurance can feel like a luxury. But it doesn’t have to. Luckily, the Health Insurance Marketplace has affordable options for every person, with any budget, including plans for $0 monthly payments with financial assistance if you qualify. 1

Why health insurance is important

Health insurance gives you piece of mind and protects you from paying too much for care — whether it’s a routine checkup or a major procedure. When you buy a health insurance plan through the Health Insurance Marketplace, you and your insurance company will share the costs for covered services. Without insurance, unexpected life events can have impacts on your overall health, finances, and state of mind.

Getting the most affordable plan

The Marketplace makes it easy for you to get a comprehensive, affordable health plan that fits your or your family’s budget. Plus, most individuals qualify for financial help through the Marketplace. Depending on your income, your monthly payment for your premium could be as low as $0 if you qualify for financial assistance that’s equal to or more than the premium. 1 This kind of assistance is commonly called a subsidy or advanced premium tax credit.

Know your options

To make sure you get the best plan for your care needs and budget, it’s also important to review your plan options in detail and to do this every year, even if you think nothing much has changed. This means looking at more than just what your monthly payment will be. Look at how much the deductible is (the amount you pay for covered services before the insurance company starts to pay their part) and the copay or coinsurance amount you pay each time you get a medical service. Also look to see if you receive discounts when you use certain pharmacies or visit certain doctors. Think about your health needs, any conditions you may have, or prescriptions you take. This all adds up to how much you’ll pay every year for your care.

Remember, health insurance should fit into your budget, not the other way around.

While some insurance carriers may come and go, Florida Blue has been serving the state for almost 80 years and is the only company that’s been available on the Marketplace in every part of Florida from the beginning. Want more information? Reach out to your neighborhood Florida Blue Center or a local licensed Florida Blue agency.

1 Based on actuarial analysis of the 2021 American Community Survey Public Use Microdata Sample (PUMS), with adjustments of Florida’s Medicaid Growth from the Agency for Health Care Administration, individual enrollment growth from CMS’ 2023 Open Enrollment Report.

Blue Cross and Blue Shield of Florida, Inc. DBA Florida Blue. An independent Licensee of the Blue Cross and Blue Shield Association.